Difference #2: User Acquisition & Privacy Landscape

If game publishing is ultimately a growth problem, User Acquisition (UA) and Privacy are two forces that define scalability.

Crucially, moving from Vietnam to China, Korea, or the US/EU, both unit economics and optimization playbooks can change dramatically. UA is not just running ads – it is part of the market structure.

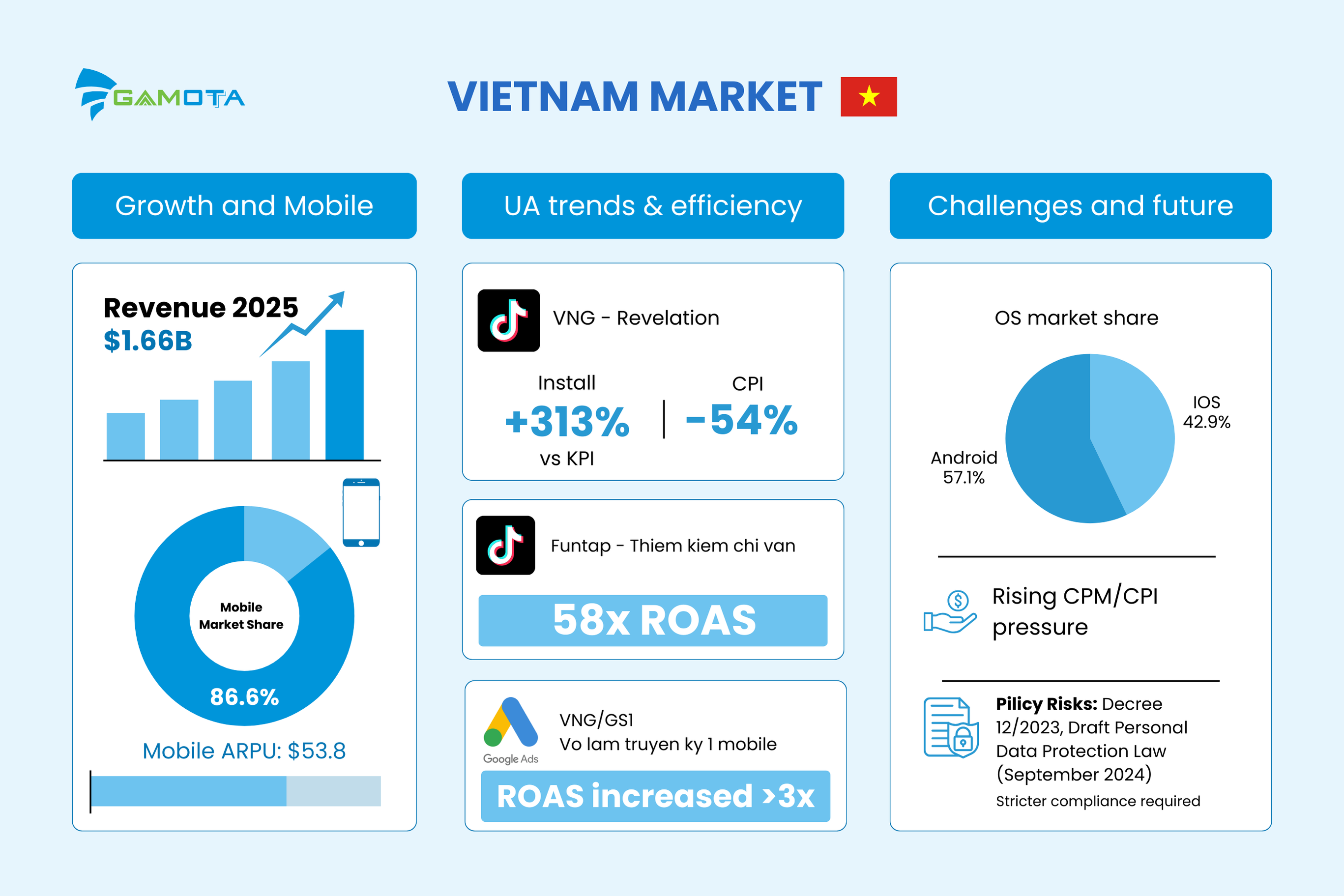

1. Vietnam: High Growth & Mobile-First Optimization

By 2025, Vietnam’s gaming industry revenue is projected to reach USD 1.66 billion and continue growing steadily (Statista, cited by VietnamNet) [1].

However, as user acquisition (UA) competition intensifies, publishers in Vietnam are increasingly prioritizing performance optimization (CPI/ROAS) rather than purely scaling for volume.

According to Antom’s Vietnam Gaming & Payment Trends report, Vietnam is a mobile-first market, with 86.6% of gamers playing on mobile.

Moreover, mobile ARPU has reached USD 53.8 – significantly higher than PC within the market’s overall spending structure [2].

Success Stories in UA Optimization

-

TikTok (VNG – Revelation): TikTok for Business reports that in Vietnam, VNG’s campaign delivered installs 313% above the KPI target while achieving a CPI 54% below the target [3].

-

TikTok (Funtap – Thien Kiem Chi Van): A Vietnam “Gaming on TikTok” case roundup reports that Thien Kiem Chi Van achieved 58x ROAS [4].

-

Google Ads (VNG/GS1 – Vo Lam Truyen Ky 1 Mobile): Think with Google highlights that ROAS on Google Ads increased by over 3x for GS1’s campaign with ‘Vo Lam Truyen Ky 1 Mobile’ [5].

The OS Advantage

Furthermore, Vietnam remains one of the more optimization-friendly UA markets in SEA, largely due to its OS mix. Android accounts for ~56.9% of mobile OS share, which means publishers are relatively less constrained by iOS privacy limitations than in iOS-heavy markets [6].

Consequently, this structure allows teams to lean more on Android-side signals and large-scale audience modeling (e.g., lookalike-style expansion) to iterate quickly.

Meanwhile, they can still treat iOS as a meaningful share (~42.7%) that requires privacy-aware measurement [7].

Future Risks

However, this advantage isn’t permanent. As the market matures, CPM/CPI pressure tends to rise. Additionally, policy risk is real: Vietnam’s privacy regime has tightened since Decree 13/2023.

Also, the Draft Personal Data Protection Law (Sept 2024) signals stricter requirements that could increase compliance burden and affect data usage in UA/measurement workflows [8, 9, 10].

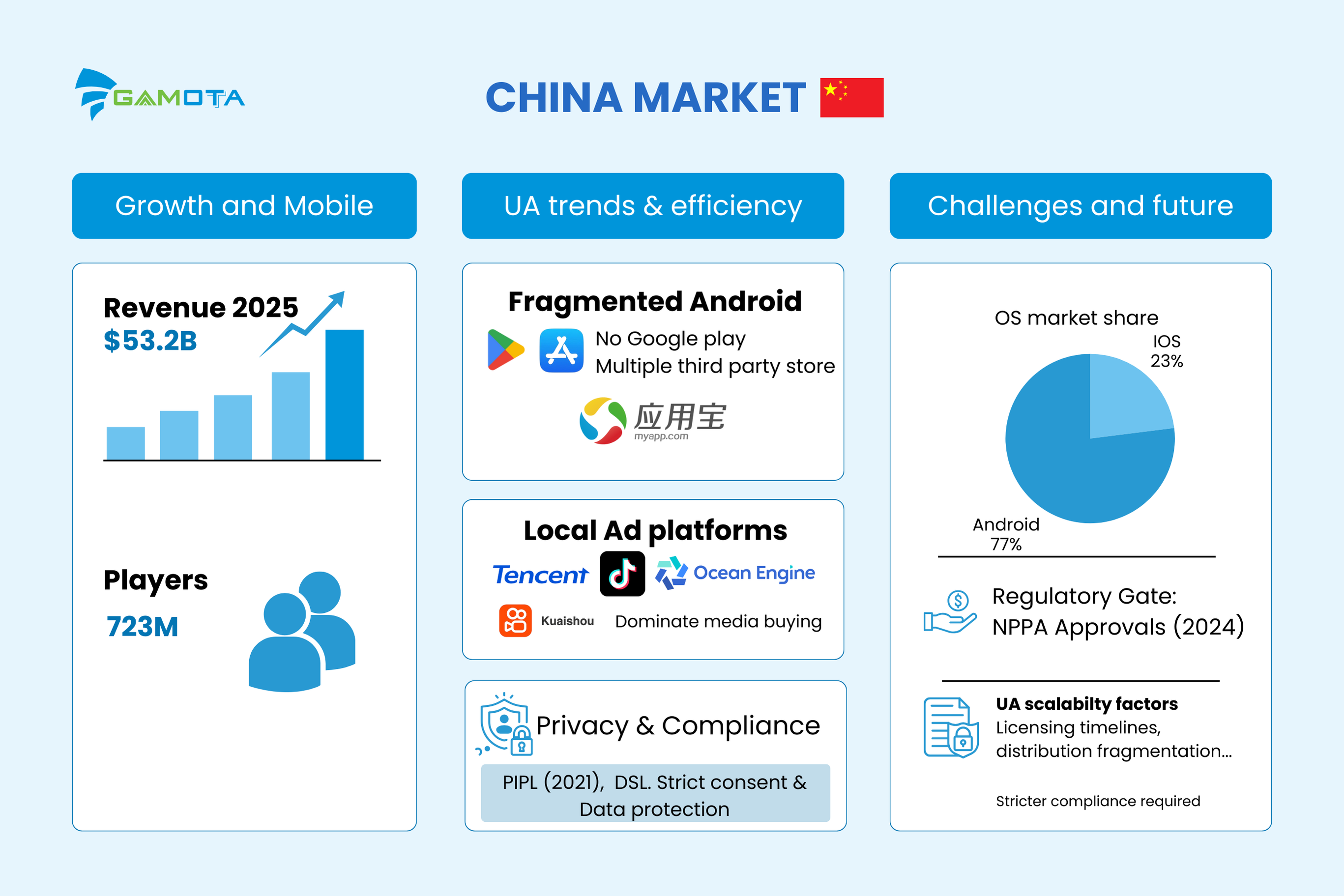

2. China: A Unique Ecosystem

As of 2025, China is the world’s largest games market, with USD 53.2B in game revenues and an estimated 723.0M players (Newzoo) [11]. China’s UA is structurally different from most global markets because Google Play is effectively unavailable.

Instead, Android distribution is highly fragmented across multiple OEM stores and third-party app stores. For example, Tencent’s Android app store MyApp (应用宝) is highlighted as the largest third-party Android store.

Therefore, publishers often need multi-store distribution strategies rather than relying on a single global store [12, 13].

Media Buying & OS Mix

For performance UA, the media mix is strongly shaped by China-native platforms.

These commonly include Tencent Ads, Ocean Engine (Douyin), and Kuaishou – reflecting a market where scale and optimization rely heavily on walled-garden ecosystems rather than global networks [14].

Regarding the OS mix, China is an Android-dominant market. In Dec 2025, Android accounted for ~77.23% mobile OS share vs ~22.39% iOS (StatCounter) [15].

This means teams can still benefit from Android scale, but optimization is increasingly defined by data governance and platform rules, not only by OS-level privacy changes.

Privacy & Regulatory Gates

China’s privacy landscape is anchored by PIPL, which took effect on Nov 1, 2021, alongside broader data/security regimes (e.g., DSL).

These frameworks elevate consent and compliance expectations, impacting how personal data can be collected and used for targeting/measurement [16, 17].

In parallel, game publishing has a strong regulatory gate through NPPA approvals. In 2024, China approved 1,416 games in total, including 110 foreign titles (reported via industry tracking) [18, 19].

As a result, UA scalability in China is not only a media-buying problem. It is also shaped by licensing timelines, distribution fragmentation, and privacy compliance, which collectively influence launch sequencing, measurement design, and budget allocation.

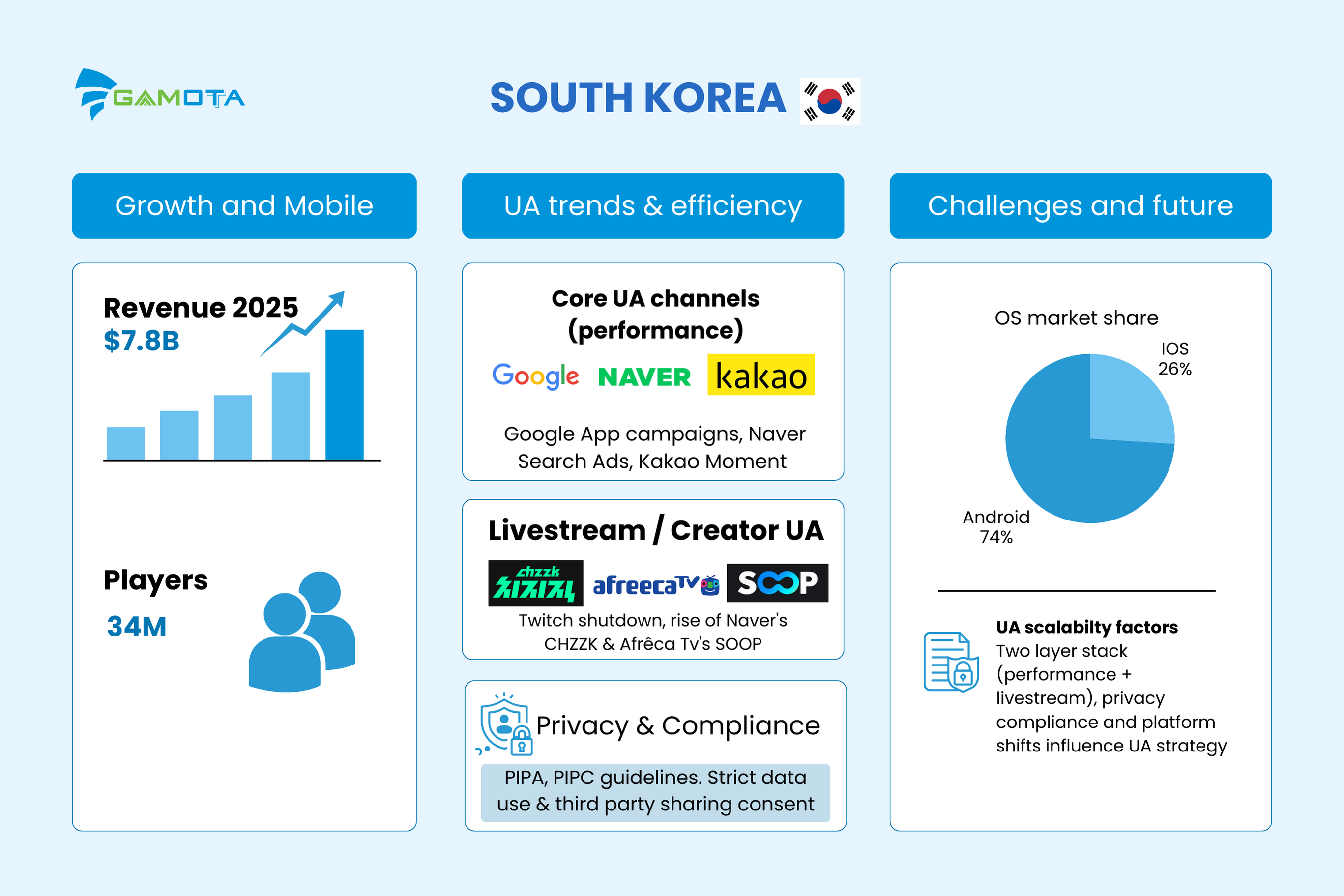

3. South Korea: High Competition & Hybrid Channels

Entering 2025, South Korea is the world’s 4th largest games market, with USD 7.8B in game revenues and an estimated 34.0M players (Newzoo) [11]. South Korea is a highly competitive UA market.

Scale typically comes from a two-layer stack: (1) performance networks for measurable installs/in-app actions, and (2) livestream/creator ecosystems that can rapidly drive demand and conversion.

Core UA Channels (Performance)

-

Google App campaigns: run across Google’s major properties (Search, Google Play, YouTube, Discover, Display Network), making it a primary scalable channel for app UA [20].

-

Naver Search Ads: a key local channel; Naver calls Search Ads its “signature ad product” [21].

-

Kakao Moment: Kakao’s ad platform for managing campaigns/creatives and measuring performance via reports [22, 23].

Livestream & Creator UA

After Twitch announced it would shut down its Korea business on Feb 27, 2024 (KST), local livestream platforms became even more important for game marketing. Most notably, these include Naver’s CHZZK (beta launched Dec 19, 2023) and AfreecaTV’s rebrand to SOOP [24].

Optimization Context

Korea is still Android-heavy (Android 73.49% vs iOS 26.02% in Dec 2025), supporting Android-side scale while iOS still requires privacy-aware measurement [25].

Korea’s UA is shaped not only by channel mix, but also by privacy compliance. Under PIPA, data use and third-party sharing for targeting/measurement require careful consent and governance.

Furthermore, PIPC’s 2024 guidelines clarify that PIPA may apply to foreign operators – making privacy a real constraint in UA measurement workflows [26, 27].

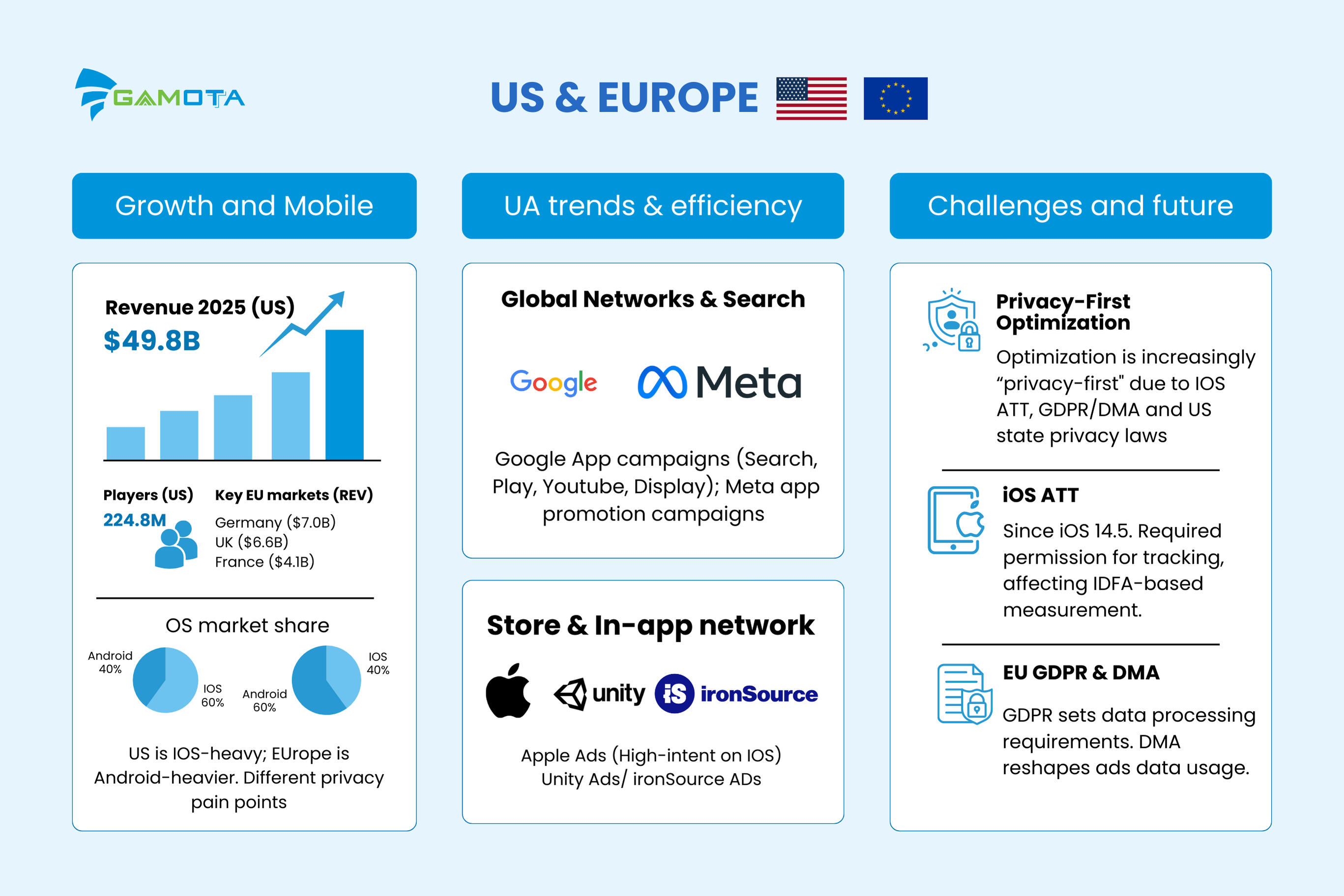

4. The US & Europe: The Privacy-First Frontier

Regarding 2025, the United States remains a top global games market at USD 49.8B in game revenues with 224.8M players (Newzoo). Major Western European markets are also sizable, including Germany (USD 7.0B), United Kingdom (USD 6.6B), and France (USD 4.1B) in 2025 revenue estimates (Newzoo) [11].

The Channel Mix

The UA landscape here is led by global networks, store search, and in-app networks:

-

Google App campaigns (distribution across Google properties such as Search/YouTube/Google Play/Display), used as a scalable engine for app installs and in-app outcomes [28, 29].

-

Meta App Promotion campaigns (optimized for installs/app events/high-value users) [30].

-

Apple Ads (App Store placements / search results) as a high-intent acquisition channel on iOS via App Store search and other placements [31, 32].

-

In-app ad networks (common in game UA) such as Unity Ads and ironSource Ads, used to acquire users inside other apps/games and optimize toward ROAS/retention/scale [33].

OS Mix

-

US (Dec 2025): iOS 59.31% vs Android 40.42% → iOS privacy constraints hit UA measurement and retargeting harder [34].

-

Europe (Dec 2025): Android 60.28% vs iOS 39.2% → Android scale is larger, but iOS is still material for revenue and needs privacy-aware measurement [35].

Privacy & Regulation

Optimization is increasingly “privacy-first” (iOS ATT + GDPR/DMA + US state privacy):

-

iOS ATT: since iOS 14.5, apps must request permission before tracking across other companies’ apps/websites (affecting IDFA-based targeting/measurement) [36].

-

EU GDPR sets requirements around processing personal data (including obligations for organizations targeting people in the EU), shaping consent/governance for UA data usage [37].

-

EU DMA enforcement is directly reshaping ad data usage: the European Commission announced Meta will offer EU users a choice around personalized ads/data sharing under the DMA (changes presented for Jan 2026) [38].

5. Conclusion

Overall, this cross-market comparison shows that UA is not a universal playbook – it is market structure. Among the four, Vietnam stands out as an attractive growth entry point.

The market is still expanding, strongly mobile-first with meaningful ARPU signals, and benefits from an optimization-friendly OS mix where Android remains the majority share.

Supported by proven local performance across short-video and major networks, Vietnam enables studios to scale efficiently, validate LTV, and iterate fast – before moving into more regulated, fragmented, or iOS-constrained markets (China, Korea, US/EU).

The opportunity window isn’t infinite: rising competition and tightening privacy requirements make privacy-ready measurement and first-party data critical to sustaining the upside.

Get the full market analysis in the Vietnam Mobile Gaming Year-in-Review by Gamota.

References

- VietnamNet Global (2025). Vietnam’s gaming industry to hit USD 1.66 billion in 2025. VietnamNet.

- Antom Knowledge (n.d.). Vietnam Gaming & Payment Trends report. Antom.

- TikTok for Business (n.d.). Case Study: VNG Revelation. TikTok.

- CafeF (2024). Gaming on TikTok: Bệ phóng mới cho ngành game Việt Nam. CafeF.

- Think with Google (n.d.). VNG Mobile Game Marketing in Vietnam. Google.

- StatCounter (2025). Mobile Operating System Market Share Vietnam. StatCounter.

- Tenjin (2024). Vietnamese Mobile Gaming in 2024: Four Billion Downloads & Emerging Trends. Tenjin.

- Frasers Law (n.d.). Vietnam’s Draft Personal Data Protection Law analysis. Frasers Law Company.

- KPMG Vietnam (2025). Vietnam tightens data protection. KPMG.

- EuroCham Vietnam (2023). Decree 13/2023/ND-CP on Personal Data Protection (PDPD). EuroCham.

- Newzoo (n.d.). Top 10 Countries by Game Revenues. Newzoo.

- AppInChina (n.d.). App Stores in China. AppInChina.

- NextAppMarket (n.d.). Resources: App Stores List. NextAppMarket.

- Campaign Asia (2024). Mini-games become major league advertisers on WeChat. Campaign Asia.

- StatCounter (2025). Mobile Operating System Market Share China. StatCounter.

- China Briefing (n.d.). The PRC Personal Information Protection Law (PIPL): Full Translation. Dezan Shira & Associates.

- DLA Piper (n.d.). Data Protection Laws of the World: China. DLA Piper.

- Game World Observer (2024). China approved over 1,400 games in 2024, up 31% YoY. Game World Observer.

- SCMP (2025). China approves 110 domestic, 3 imported video games in February. South China Morning Post.

- Google Ads (n.d.). App Campaigns for Engagement. Google.

- Naver Corp (n.d.). Naver Search & Display Advertising Services. Naver.

- Kakao Developers (n.d.). KakaoMoment: Common Guide. Kakao.

- Kakao Developers (n.d.). KakaoMoment: Reporting Guide. Kakao.

- Twitch (2023). An Update on Twitch in Korea. Twitch Blog.

- StatCounter (2025). Mobile Operating System Market Share South Korea. StatCounter.

- PIPC (n.d.). Personal Information Protection Commission Notice. PIPC Korea.

- Kim & Chang (n.d.). Legal Insights: Korea Data Protection. Kim & Chang.

- Newzoo (2025). Global Games Market to Hit $189 Billion in 2025. Newzoo.

- Newzoo (2025). Global Games Market Update Q2 2025. Newzoo.

- Meta for Business (n.d.). Facebook Business Help Center. Meta.

- Apple Developer (n.d.). Promote Your App. Apple.

- Apple Search Ads (n.d.). Ad Placements: Search Results. Apple.

- Unity (n.d.). User Acquisition Solutions. Unity.

- StatCounter (2025). Mobile Operating System Market Share United States. StatCounter.

- StatCounter (2025). Mobile Operating System Market Share Europe. StatCounter.

- Apple Developer (n.d.). User Privacy and Data Use. Apple.

- European Union (n.d.). Data Protection under GDPR. Your Europe.

- European Commission (2025). Meta commits to give EU users choice on personalised ads under Digital Markets Act. European Commission.