Difference #1: Top Game Performance

Why does a game win in Market A but lose in Market B?

When we place download data next to IAP (In-App Purchase) data, a recurring pattern emerges. Often, the genre driving downloads does not coincide with the genre generating revenue.

In many markets, “easy-to-enter” games achieve massive user scale. This is due to low barriers regarding devices, time commitment, and skill. However, the money concentrates elsewhere. It flows into midcore and hardcore titles. These games feature long lifecycles, deep progression systems, and distinct payment mechanisms. Specifically, they “tap into” social dynamics or competitive drives.

This difference is crucial from a strategic perspective. It forces publishers to answer a fundamental question. Is the product optimized for volume (maximizing user growth)? Or is it optimized for value (maximizing revenue per user)?

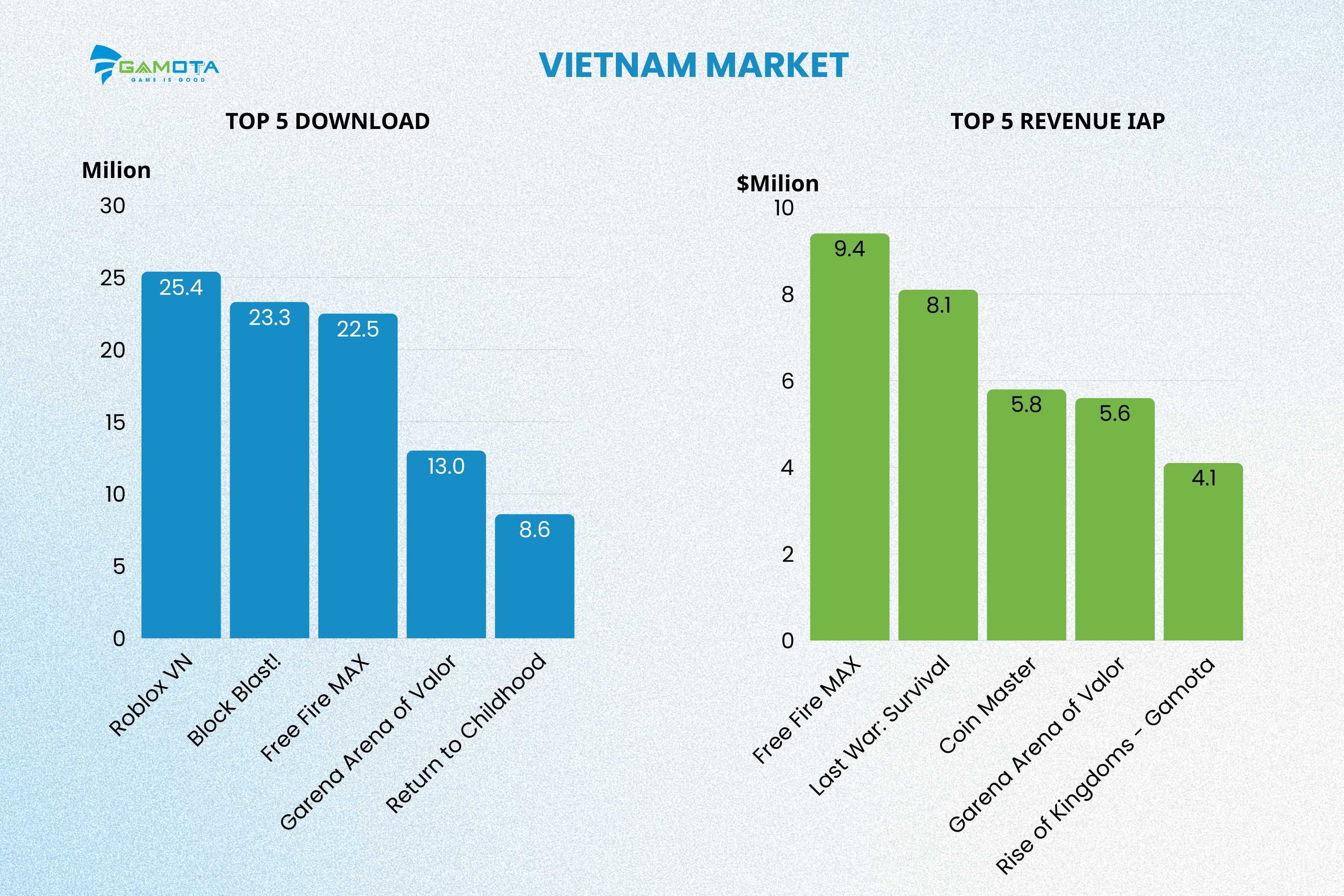

The Vietnam Market: Mass Market vs. Payer Niche

In Vietnam, the gap between the massive player base and high spenders is distinct. It reflects a market that is “bifurcated” between a casual social group and a payer niche.

According to App Magic data, we see the following trends:

Top 5 Downloads (Accounting for 32.59% of the Top 50):

-

Roblox VN (25.4M)

-

Block Blast! (23.3M)

-

Free Fire MAX: Winterlands (22.5M)

-

Garena Arena of Valor (13.0M)

-

Return to Childhood (8.6M)

Top 5 Revenue IAP (Accounting for 36.05% of the Top 50):

-

Free Fire MAX: Winterlands ($9.4M)

-

Last War: Survival VN ($8.1M)

-

Coin Master ($5.8M)

-

Garena Arena of Valor ($5.6M)

-

Rise of Kingdoms – Gamota ($4.1M)

To explore more data and insights on Vietnam’s gaming market, check out the Vietnam Gaming Year-In-Review 2025 report right here.

Analyzing Vietnam’s Monetization Trends

Puzzle and Sandbox genres (Roblox, Block Blast!) dominate downloads. However, the real cash flow pours into Midcore/Hardcore groups. These include 4X Strategy and Battle Royale titles.

Notably, Last War: Survival VN ranks 2nd in revenue despite not making the Top 5 in downloads. This proves its ability to effectively monetize the high-value mature demographic [1].

The case of Roblox explains why a title can top downloads but not IAP. First, the UGC model makes revenue dependent on the creator economy. Second, the young user base (8 – 15 years old) has low spending power. Most importantly, the motivation to play leans towards “meetup – entertainment – interaction.” It does not emphasize “must-win,” resulting in low spending pressure [2, 3, 4].

Conversely, Free Fire tops both downloads and IAP because it hits the right market conditions. It has a strong esports foundation that creates distinct “aspiration.” Furthermore, it runs well on low-end specs and offers a Battle Pass at an acceptable price point.

Last War: Survival VN demonstrates a familiar midcore paradox. One doesn’t need top downloads to achieve top revenue. Instead, they must target the 30–45 payer demographic, exploit guild warfare, and use time-gating to turn speed-ups into a recurring need [5, 1].

Conclusion: Vietnam is a bifurcated market. Publishers must choose between a Volume strategy (casual) or a Value strategy (competitive).

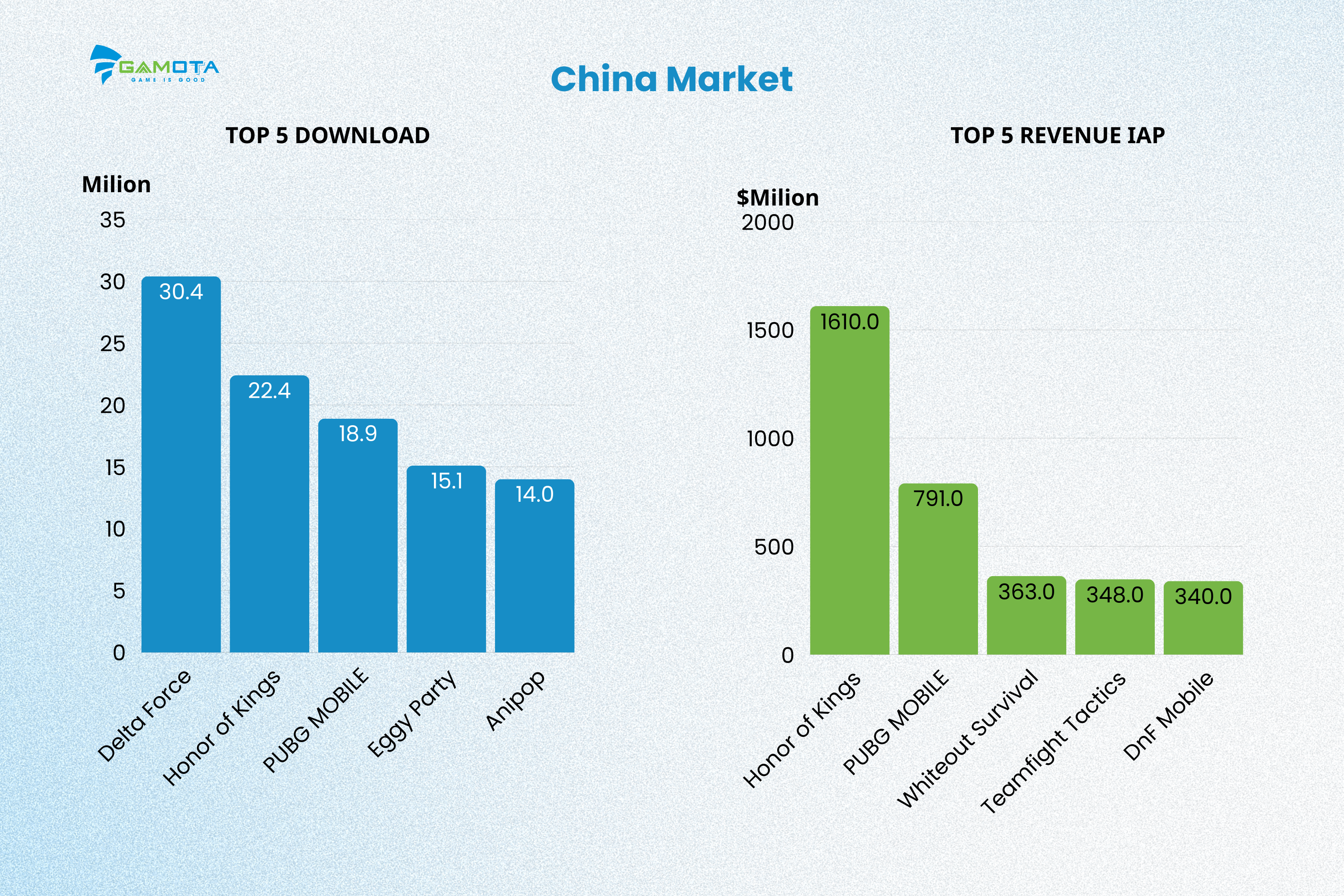

The China Market: Absolute Dominance of the “Ecosystem”

In China, products within the Tencent and NetEase ecosystems capture nearly half of the market’s IAP cash flow.

According to App Magic data:

Top 5 Downloads (Accounting for 28.95% of the Top 50):

-

Delta Force (30.4M)

-

Honor of Kings (22.4M)

-

PUBG MOBILE (18.9M)

-

Eggy Party (15.1M)

-

Anipop (14.0M)

Top 5 Revenue IAP (Accounting for 47.68% of the Top 50):

-

Honor of Kings ($1.61B)

-

PUBG MOBILE ($791M)

-

Whiteout Survival ($363M)

-

Teamfight Tactics ($348M)

-

DnF Mobile ($340M)

Explore the genres dominating China’s gaming market in the Vietnam Gaming Year-In-Review 2025 report right here.

Revenue concentration in China is at a record high (nearly 48%). The dominance of Honor of Kings stems not only from gameplay but also from a closed social network. This turns in-game spending into a form of social communication.

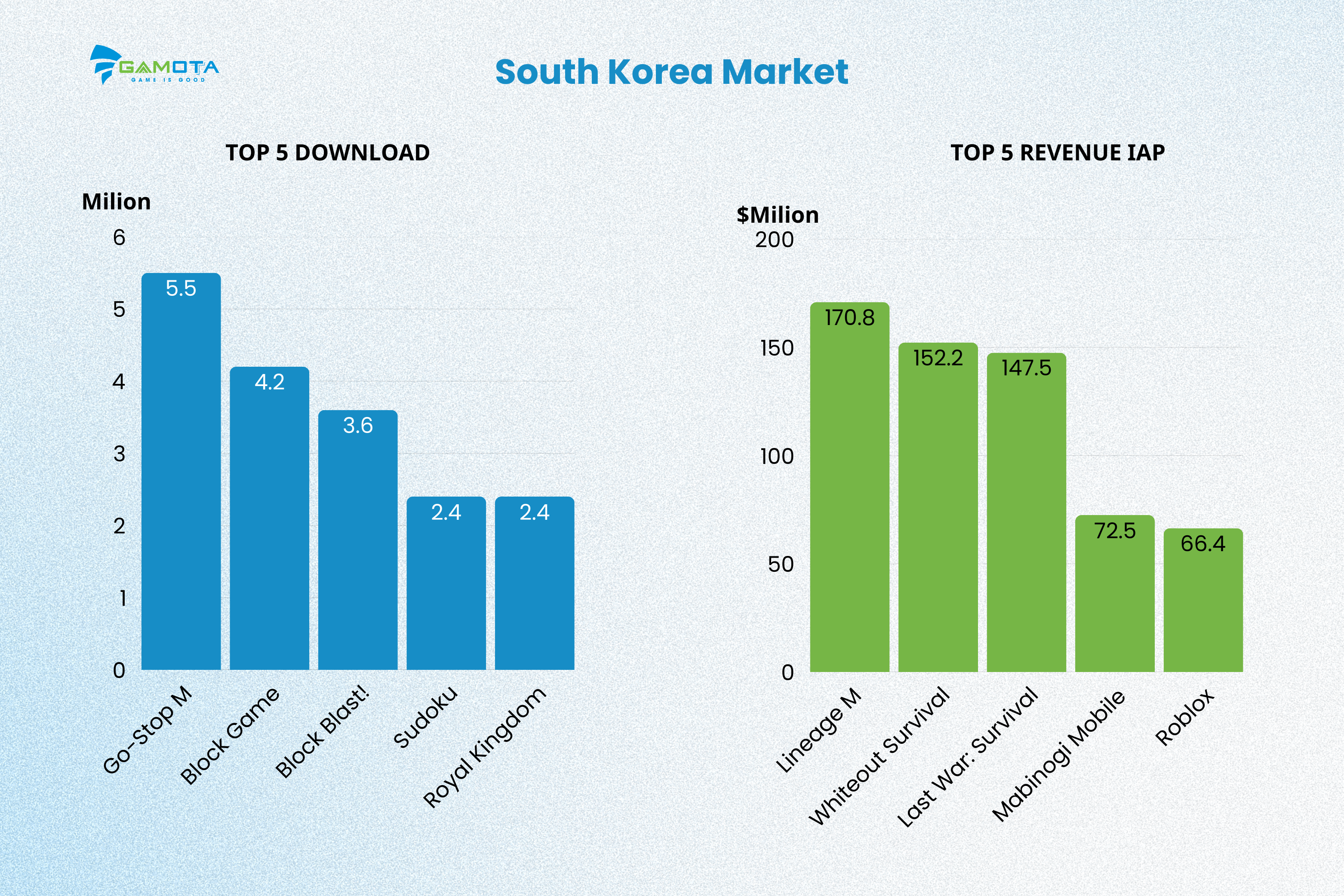

The South Korea Market: The Fortress of IP Loyalty

South Korea is a market where players download Casual games for short-term entertainment. However, they dedicate their entire “budget” to MMORPG and 4X Strategy worlds.

According to App Magic data:

Top 5 Downloads (Accounting for 24.26% of the Top 50):

-

Go-Stop M (5.5M)

-

Block Game (4.2M)

-

Block Blast! (3.6M)

-

Sudoku (2.4M)

-

Royal Kingdom (2.4M)

Top 5 Revenue IAP (Accounting for 35.36% of the Top 50):

-

Lineage M ($170.8M)

-

Whiteout Survival ($152.2M)

-

Last War: Survival ($147.5M)

-

Mabinogi Mobile ($72.5M)

-

Roblox ($66.4M)

Understanding Korean Player Behavior

This disparity is rooted in behavioral context. Casual games in Korea function primarily as “time killers” for short sessions. Conversely, spending behavior is strongly driven by competitive social features. These features establish status, such as guilds, leaderboards, and rankings [6, 7, 8].

Community culture (PC bangs/clans) ties spending to prestige rather than just personal utility. Lineage maintains revenue longevity thanks to sunk costs. Players accumulate significant investment over time. Consequently, guild relationships become social assets. The economy is deep enough for whales to view it as a “value system.” Therefore, Korea is a high risk – high reward market.

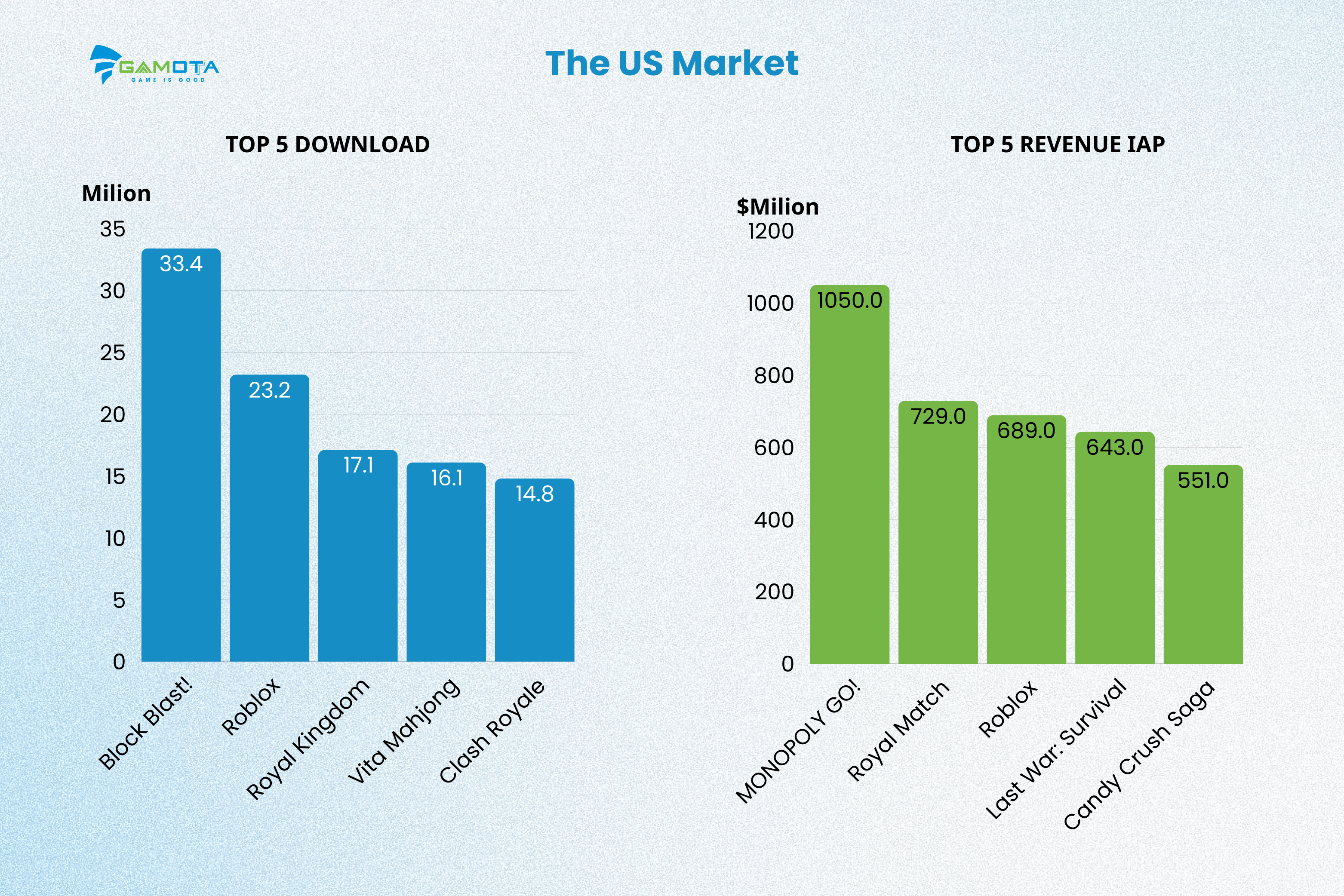

The US Market (Europe-US): The Empire of Live-ops and Convenience

The US market shows fair competition in user acquisition. However, it is extremely specialized in monetization.

According to App Magic data and internal Gamota data:

Top 5 Downloads (Accounting for 21.22% of the Top 50):

-

Block Blast! (33.4M)

-

Roblox (23.2M)

-

Royal Kingdom (17.1M)

-

Vita Mahjong (16.1M)

-

Clash Royale (14.8M)

Top 5 Revenue IAP (Accounting for 43.04% of the Top 50):

-

MONOPOLY GO! ($1.05B)

-

Royal Match ($729M)

-

Roblox ($698M)

-

Last War: Survival ($643M)

-

Candy Crush Saga ($551M)

Monopoly GO is notable. It shows that a “light” game can still achieve billion-dollar scale. This happens if it converges the right conditions. These include familiar IP, an easy social loop, and a dense event cadence. Additionally, purchase packages must focus on “convenience” rather than blatant P2W [9].

Simultaneously, whales in the EU-US are often older. They lean towards “pay for convenience.” In contrast, China and Korea often see younger, more competitive whales. Consequently, the EU-US favors “sophisticated” monetization models. Players feel they are buying to optimize their experience, not just to win [10, 11].

Key Takeaways and Strategic Conclusion

In summary, the four markets demonstrate four different ways of distributing Downloads and IAP:

-

Vietnam: Splits between mass market and payer niche.

-

China: Concentrates on competitive ecosystems and IP.

-

South Korea: Pays heavily for prestige and IP loyalty.

-

EU-US: Pays heavily for convenience and long-term optimized mechanisms.

From a market research perspective, this leads to a pragmatic conclusion. Genres do not automatically succeed everywhere. Success depends on motivational structures, affordability, and economy designs tailored to each region.

Why Vietnam Stands Out

Compared to China’s “closed ecosystem” or South Korea’s IP barriers, Vietnam emerges as an attractive destination. It offers a unique intersection of factors.

Vs. EU-US (Pay for Convenience): While US spending pours into Monopoly GO (light entertainment), revenue in Vietnam flows toward Free Fire or Last War. This indicates that Vietnamese users spend for “Status” and social competition. This opens huge opportunities for games with deep Guild/PvP features.

Vs. South Korea (Pay for IP): In Korea, Lineage M dominates thanks to its brand. However, in Vietnam, Last War secured Top 2 in revenue without a massive IP. This proves Vietnamese gamers are open-minded. They are willing to pay for engaging gameplay and community aspects rather than relying solely on established IP.

Final Verdict: Studios can leverage low User Acquisition (UA) costs in Vietnam to attract a massive volume of Casual players. Then, they can utilize Social/Competitive mechanisms (similar to the Chinese model) to convert them into loyal Payers.

——————–

References

- MAF (2025). Mid-Core Games: Latest Data and Top UA Strategy for 2025

- Backlinko (2026). Roblox User and Growth Stats You Need to Know in 2026.

- Huang, J. (2023). Analysis on the Young Age of Roblox Platform Audience Targeting.

- Roblox Corporation (n.d.). The Roblox user base. Roblox Creator Documentation.

- Gamesforum (2025). Mobile Midcore Gaming Report. InvestGame.

- MAF (2025). Mobile Gaming in South Korea: Latest Numbers & Key Strategies. MAF.

- adjoe (2025). South Korea: $6.8 B Mobile Gaming Market You Can’t Afford to Ignore.

- Appfigures (2025). This Week in Apps – Games Are Not the Same. Appfigures.

- Sensor Tower (2024). Monopoly GO! Rolls Past Revenue Milestones: User Demographics and Market Insights.

- CNBC (2018). ‘Pay-to-win’ video games: The differences between US and Chinese gamers.

- Think with Google (n.d.). PC & Mobile Game Monetization Models: Asia Pacific vs. The West.